Macro Insights: Bitcoin, Altcoins, and What’s Coming

What the charts are saying: Key resistance levels, institutional inflows, and how elections could trigger Bitcoin’s next breakout.

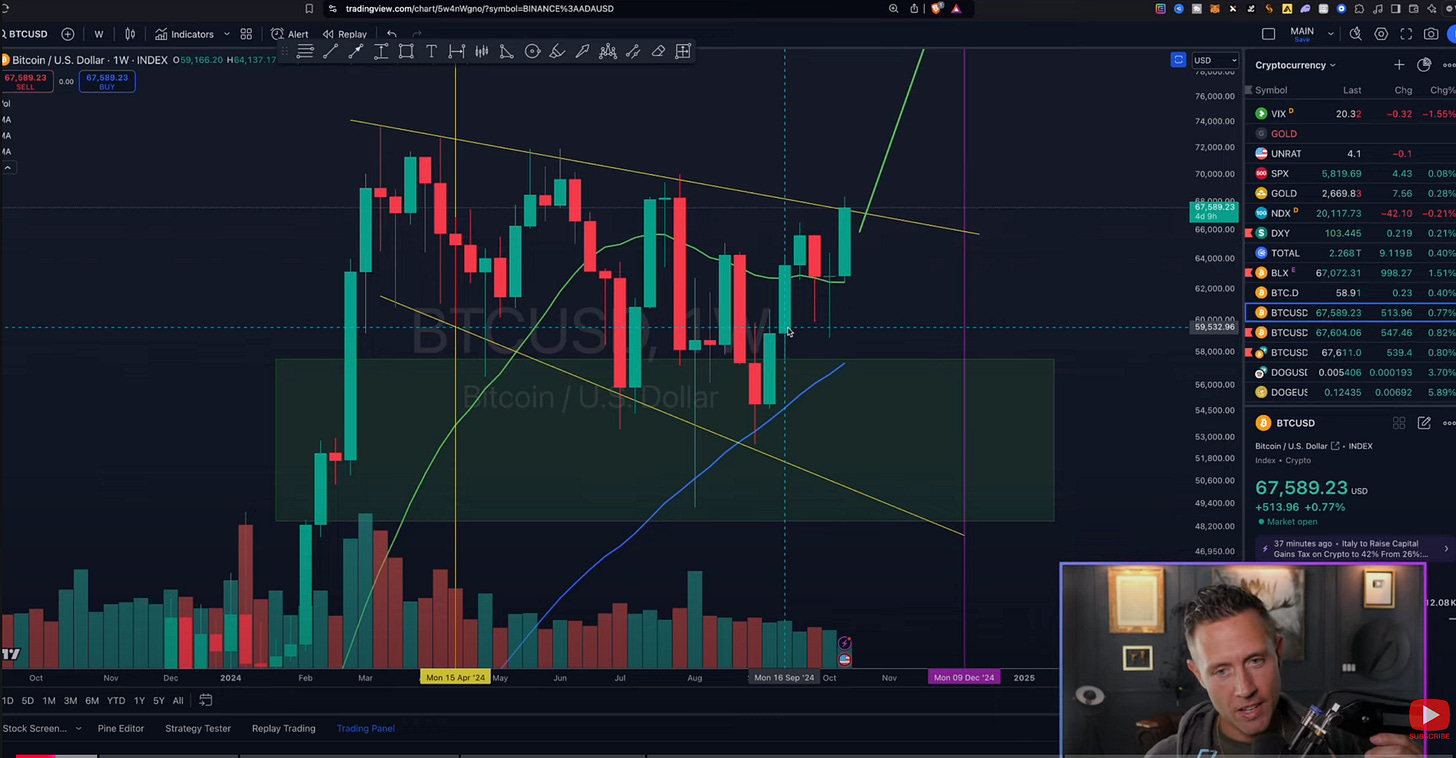

Hey everyone, Dan here with your weekly crypto roundup! The past week has been nothing short of intense as Bitcoin continues to flirt with key resistance levels, creating both excitement and anxiety across the market. We’re sitting just below $70k, and with Bitcoin bulls facing a critical area of resistance, the question remains: Are we on the verge of the next major breakout?

October 16: The Bull Market Trigger

Starting on October 16th, I talked about the significance of Bitcoin’s latest weekly candle, which formed a textbook example of bullish momentum. The context here is crucial. We’ve been through this grind before, and right now, it feels like we’re inching closer to something big. Bitcoin continues to hold above the key level I call the “bull market doors,” and this consolidation is historically one of the most macro bullish indicators we could ask for. Remember, this is all playing out as expected, according to the data we’ve been tracking for years.

While I often see negative comments, especially from those who think I’m overly bullish, it’s important to stay focused on the facts. Cycles are driven by data, not emotion, and if you zoom out on the charts, you’ll see that the long-term trend remains intact. Bitcoin’s breakout above $37k last November is still playing out, and as we’re consolidating above key levels, it’s setting up for the next leg higher.

October 17: Bitcoin Dominance and Altcoin Season Setup

On October 17th, we shifted the conversation to Bitcoin dominance and its potential impact on the broader crypto market. What we’re seeing is a significant power move in Bitcoin’s dominance, which has left many altcoins struggling. But here’s the key takeaway: Historically, these dominance surges have preceded the start of an altcoin season. This setup, while painful in the short term for altcoins, is a critical precursor to their explosive growth.

The data shows that Bitcoin dominance tends to rise before it sharply falls, signaling the beginning of a new altcoin season. Right now, we’re approaching that key Fibonacci level for dominance—around 60-65%—which has acted as a major turning point in previous cycles. If dominance starts to reverse from here, we could be in for a massive altcoin run, and that’s something I’m closely watching. Timeframe-wise, we’re just months away from a potential move, so buckle up.

In addition, I discussed two altcoins in particular: ADA and DOGE. ADA remains, in my opinion, one of the most undervalued blue-chip cryptos out there, while DOGE is positioning itself for a big play as the top meme coin. Both of these projects have the potential for strong performance in the next bull cycle, especially as Bitcoin approaches its key resistance areas.

The November 5th Election Effect

Moving into October 19th and 20th, the focus was on something many might overlook—the upcoming U.S. elections on November 5th. Historical data shows that election periods often serve as major catalysts for Bitcoin. In the last few cycles, we’ve seen Bitcoin enter what I like to call “up-only mode” right after election day. And given where we are in the current cycle, it looks like we’re setting up for a similar move this time around.

So what does this mean for Bitcoin? Well, we’re currently in the midst of a significant consolidation pattern that’s lasted over half a year. If Bitcoin follows the same path as previous cycles, we could see a breakout around or after November 5th. The weekly MACD—a key momentum indicator—has just crossed into bullish territory, signaling that we may be on the verge of a major move.

And here’s the kicker: Institutional interest is skyrocketing. BlackRock’s Bitcoin ETF has already become the third-largest ETF in terms of year-to-date inflows, growing faster than gold ETFs did in their early years. When you combine this institutional momentum with historical election cycle data and the upcoming Bitcoin halving in 2024, the pieces are aligning for what could be one of the biggest Bitcoin rallies we’ve ever seen.

Short-Term Analysis: Resistance and Support

Now, let’s zoom in a bit on what to expect in the short term. Bitcoin is currently battling intense resistance around the $67k-$70k range. If we can break through this zone, the next target is the all-time high around $74k, and from there, it’s uncharted territory.

However, I also want to stress the importance of being prepared for a potential throwback. If Bitcoin gets rejected here, we could see a dip back to the $62k-$64k support zone, which would be a healthy pullback before another attempt at a breakout. In fact, throwbacks like this are often needed to build momentum for the next leg higher. This is why it’s so crucial to stay level-headed and not get caught up in the day-to-day volatility.

We’ve got to remember, we’re still early in the broader cycle. The macro story for Bitcoin is still unfolding, and dips are part of that journey. What I’m watching closely is how Bitcoin interacts with its key support levels. If we hold around the $62k-$64k range, it would be a very bullish signal for the next breakout attempt.

Altcoins: ADA and DOG in Focus

Altcoins are still feeling the pressure as Bitcoin dominates the narrative, but that could change quickly. I’m keeping a close eye on ADA and DOG in particular. ADA, which is currently testing its 20-week moving average, has a history of making explosive moves once it breaks above this level. If ADA can break through this resistance, it could easily head back toward $0.50 or higher, especially as Bitcoin enters its parabolic phase.

DOG, on the other hand, remains one of my top picks in the meme coin category. While it may seem like a high-risk play, DOG has massive upside potential, especially with the growing narrative of it being the number one meme coin on Bitcoin. With the possibility of major exchange listings and the momentum of the meme coin super cycle, DOG could surprise everyone by flipping DOGE and capturing a much larger market share.

The Bigger Picture: Long-Term Focus

At the end of the day, it’s all about the bigger picture. The short-term volatility can be nerve-wracking, but zoom out, and you’ll see the same story playing out that we’ve seen in previous cycles. Bitcoin is still in a strong uptrend, and all signs point to further upside, especially as we approach key dates like November 5th and the Bitcoin halving in 2024.

The key here is to stay patient and disciplined. This is a long game, and those who can weather the short-term noise are the ones who stand to benefit the most when the market really takes off. As a macro investor, I’m focused on making smart, data-driven decisions, and I encourage you all to do the same.

Final Thoughts and What to Watch Next

So what’s next? In the immediate future, keep a close eye on Bitcoin’s interaction with the $67k-$70k resistance zone. If we break through, it could be the start of a major move toward new all-time highs. If we get rejected, watch the $62k-$64k support area for signs of a healthy pullback before another attempt at breaking out.

As for altcoins, stay patient. We’re approaching the time when altcoin season historically kicks off, and while it may feel frustrating now, the payoff could be huge once Bitcoin makes its next move.

Thanks for cruising through the weekly update! As always, hit that subscribe button if you haven’t already, and I’ll see you in the next video. Stay focused, stay patient, and God bless.

Dan