Crypto Chaos Looms: What a Contested U.S. Election Could Mean

(LISTEN NOW)

Hey everyone,

With the U.S. presidential election only a day away, it’s time to take a serious look at what this could mean for the crypto markets—not just in the short term, but potentially for months to come. If you’ve been following the narrative, you know that crypto speculators have been pouring billions into prediction markets like Polymarket and Kalshi. But it’s not just about who wins; it's about what happens after the ballots are counted.

The Unthinkable Scenario: A Split Verdict?

Mike Alfred hit the nail on the head when he recently posted on X: “There is one election night outcome NO ONE is talking about: Fox News declares Trump winner and CNN simultaneously declares Harris winner. This unprecedented rift... would send BTC ballistic as the world's best decentralized system.”

Now, think about this: a split in mainstream media calls could lead to weeks or even months of legal battles, political bickering, and sheer chaos. Both sides digging in their heels, neither conceding—this is the kind of uncertainty that traditional markets dread, but it’s also where crypto often finds its most unexpected narrative.

What Could This Mean for Bitcoin?

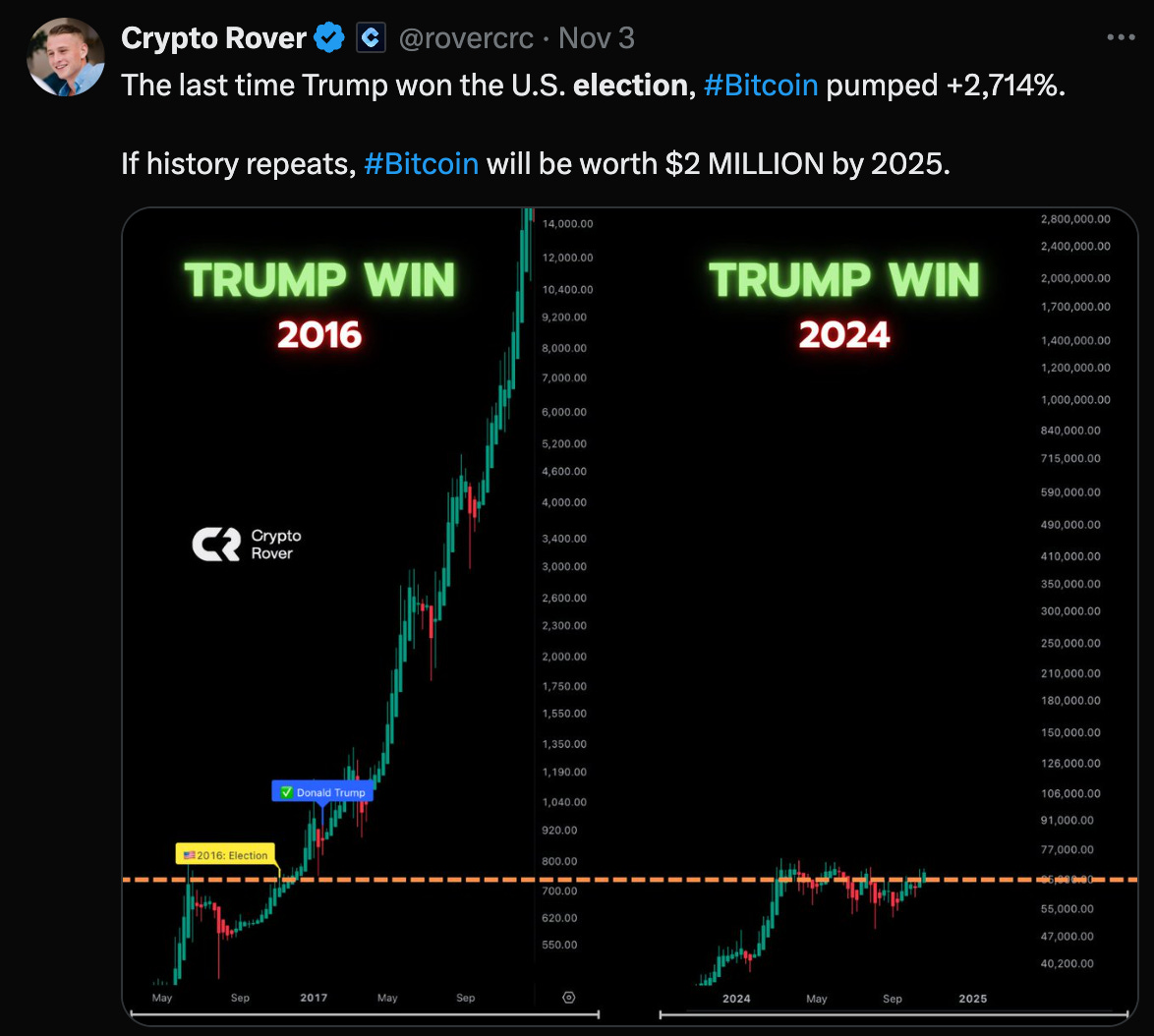

To add fuel to this speculative fire, Crypto Rover pointed out, “The last time Trump won the U.S. election, #Bitcoin pumped +2,714%. If history repeats, #Bitcoin will be worth $2 MILLION by 2025.” While those numbers may sound audacious, they underscore an important point: elections have been catalysts for BTC in the past.

2012: Bitcoin surged 12,000% in the year following the election.

2016: BTC jumped around 3,000% after Trump’s win.

2020: The post-election rally saw Bitcoin climb 478% amid the COVID-19 pandemic.

Each time, Bitcoin has surged after the election dust settled. But here's the twist: all those events had relatively clear outcomes, even if the political landscape was turbulent. This time, we could be facing a period where clarity is in short supply.

An Era of Prolonged Uncertainty

The idea that we might wake up on November 6 with conflicting declarations—Fox News calling a Trump win and CNN siding with Harris—shouldn't be dismissed as mere speculation. This would create a climate of heightened anxiety, not just for the public but for investors as well. The longer the dispute drags on, the more fuel it adds to an already volatile fire.

Markets don’t like unknowns, and a drawn-out battle over the legitimacy of the election could shake confidence in traditional financial systems. Enter Bitcoin: decentralized, borderless, and increasingly seen as a hedge against political dysfunction. If we find ourselves in a standoff with no clear outcome, BTC could rally as people look for a safe haven.

Expect Volatility—And Opportunity

If there’s one thing to brace for, it’s the kind of volatility that can shake weak hands out of the market. Prediction platforms might offer a glimpse of sentiment, but as Michael Cahill from Douro Labs pointed out, “Your average voter isn’t spending time or money on prediction markets – those platforms are being dominated by crypto-native users, and those users are voting for Trump.”

So while billions in bets might suggest one narrative, it’s the aftermath that will write the real story. Should the election spiral into months of courtroom drama and political theater, BTC could become the escape route for those looking to navigate through a new age of prolonged uncertainty.

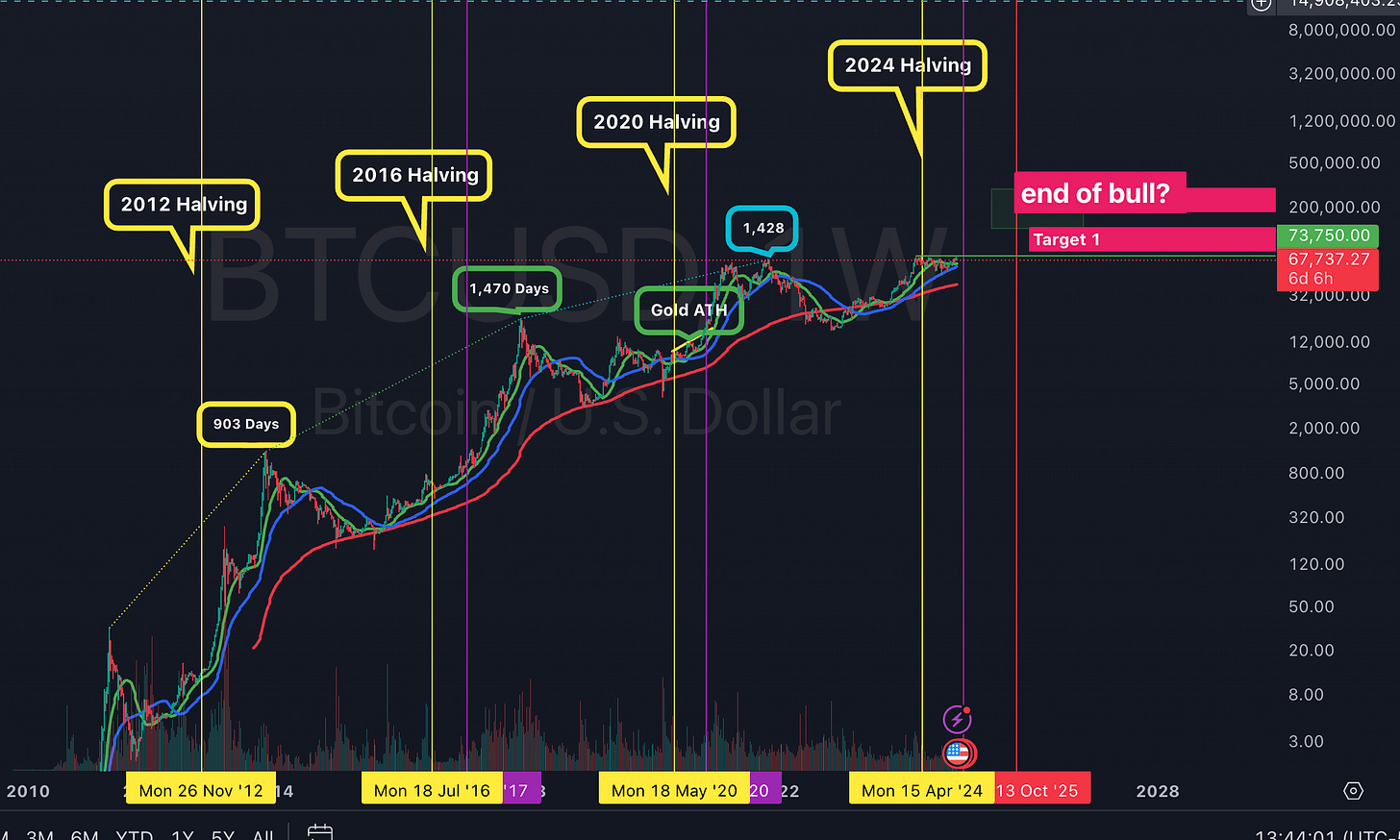

Either way…ZOOM OUT!

Stay sharp, stay informed, and get ready for what might be one of the most unpredictable periods in crypto history.

God bless!